How To Make Money In Alpha 3.1

- Dividend Strategy

Beat The Recession With Dividends - Office 3

Oct. xvi, 2018 12:48 PM ET ABBV, ADP, AFL, APD, BEN, CFR, CTAS, DCI, DOV, ECL, GWW, HP, HRL, ITW, LOW, MMM, SJW, SRCE, TGT, TROW, VFC, WBA 32 Comments 12 Likes

Summary

- I needs much more than $59,000 to brand $33,726 in dividend income immediately.

- If one looks to dividend growth instead of yield, it may accept years to decades to accumulate enough dividend income.

- If an investor has $59,000 to invest, it can take him as niggling as 14 years to earn enough dividend income to embrace the costs of retirement.

This is the tertiary article of this series focusing solely on dividend income to beat a recession. While cost may autumn in a recession, dividends may ascent. In the first article "Beat The Recession With Dividends," I created three portfolios of safe loftier-yield dividend aristocrats with a combined value of $850,000 and $950,000 to produce $33,726 per year, the average cost of retirement minus social security. In the second article "Shell The Recession With Dividends - Function 2," I showed that it is possible to pick relatively safety high-yield dividend stocks with $300,000-400,000 to get the same $33,726 per yr in dividend income. But since the median retirement account balance was simply $59,000 as of Baronial 2018, is it possible to support retirement costs with dividend income using merely $59,000? Since $33,726 is about 57% of $59,000 and that information technology is impossible to become a dividend yield of 57%, we must employ dividend growth stocks to make enough in dividends to support retirement costs. How many years would it take to practice this? While the previous two articles focused on beating a current or near-term recession, this article will focus on chirapsia a futurity recession.

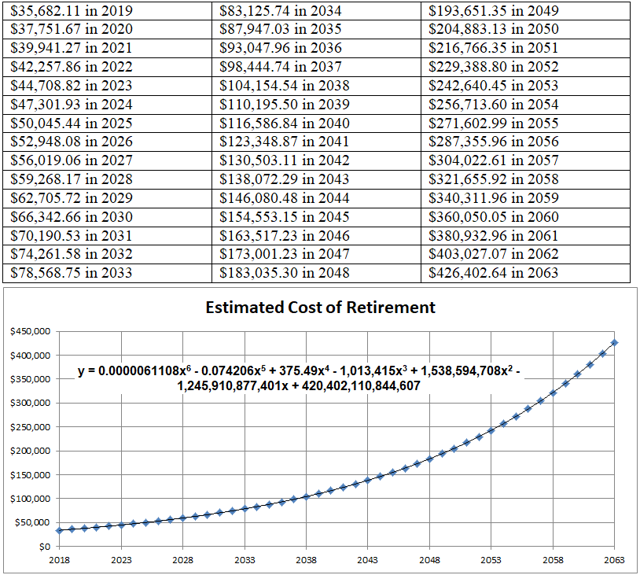

Outset, we must calculate what the retirement cost is each year in the futurity. The graph and tabular array beneath estimate the cost of retirement over time using $33,726 and the average rate of increase in retirement costs per yr, which is 5.eight%.

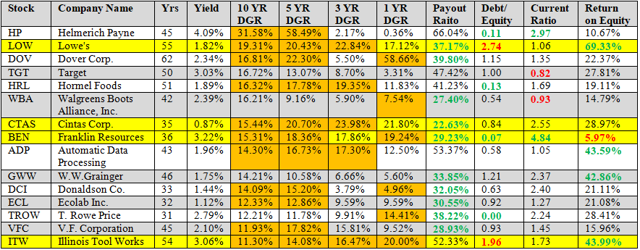

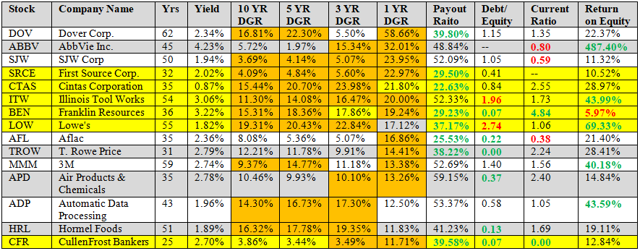

Adjacent, we must find dividend growth stocks with a high dividend growth rate and a high probability of growing their dividends in the future. To do this, two tables were created below. Tables 1 and 2 list the top 15 dividend aristocrats with the highest 10-yr and 1-year dividend growth rates respectively. Each tabular array was created past listing the 90 dividend aristocrats by decreasing dividend growth rates and selecting the top fifteen companies. Statistics were added that seem to exist important for ensuring the sustainability of the dividend. The dividend growth rates, payout ratio, and render on equity came from Seeking Alpha. The current ratio (plus payout ratio for HP) came from Yahoo Finance, while the debt/disinterestedness ratio came from GuruFocus. "Practiced" numbers are highlighted green, "warning" numbers are highlighted red, cells, where dividend growth rates were increasing, are highlighted orangish, and rows with the best dividend growth trend and numbers are highlighted xanthous. The years in the table are years of dividend growth.

Table ane: 15 Highest 10-Year DGR Dividend Aristocrats

Source: Created from Dividend Aristocrats: 25-Twelvemonth Dividend Increasing Stocks

Table 2: 15 Highest 1-YR DGR Dividend Aristocrats

Source: Created from Dividend Aristocrats: 25-Year Dividend Increasing Stocks

Companies with increasing dividend growth rates from 10-5 YR, v-three YR, and 3-i Year:

- Tabular array 1: Illinois Tool Works (ITW)

- Table 2: 1st Source Corp. (SRCE), Illinois Tool Works, and SJW Corp. (SJW)

Companies with increasing dividend growth rates from x-5 YR and v-3 YR:

- Tabular array 1: Automated Information Processing (ADP), Cintas Corp. (CTAS), Hormel Foods (HRL), and Lowe's (Depression)

- Table 2: Automated Information Processing, Cintas Corp., Hormel Foods, and Lowe'south

Companies with increasing dividend growth rates from x-v YR and three-1 YR:

- Table 1: Donaldson Co. (DCI), Dover Corp. (DOV), and Franklin Resources (BEN)

- Table two: Dover Corp., Franklin Resources, and 3M (MMM)

Companies with increasing dividend growth rates from 10-five Year:

- Table 1: Ecolab Inc. (ECL), Helmerich Payne (HP), and V.F. Corporation (VFC)

Companies with increasing dividend growth rates from 5-3 Yr and 3-ane Yr:

- Table 2: AbbVie Inc. (ABBV), Air Products & Chemicals (APD), and Cullen/Frost Bankers (CFR)

Companies with increasing dividend growth rates from 3-1 YR:

- Table 1: T. Rowe Price (TROW) and Walgreens Boots Brotherhood, Inc. (WBA)

- Table 2: Aflac (AFL) and T. Rowe Cost

Companies with decreasing dividend growth rates from 10-5 YR, 5-3 Year, and iii-1 YR:

- Table ane: Target (TGT) and Due west.W.Grainger (GWW)

Growing dividends are a sign of potential financial strength. Increasing dividend growth rates could point a dividend growth visitor that is experiencing accelerating growth and potentially greater dividends growth rates in the future. Also, decreasing dividend growth rates could betoken a dividend growth company that is experiencing decelerating growth. Table two found more dividend growth companies with accelerating growth than Table i. And Table 2 had more highlighted yellowish rows than Table 1. Looking at the yellow highlighted rows, both Table 1 and Table 2 has Cintas Corp., Franklin Resources, Illinois Tool Works, and Lowe's. Only Table 2 added Cullen/Frost Bankers and Kickoff Source Corp.

- Cintas Corp., a provider of corporate uniforms and business services, seems to have 10-yr, 5-yr, and 3-twelvemonth dividend growth rates that rose from 15% to 23%, but the rate could fall to 20% in the future due to the decline in its 1-twelvemonth dividend growth rate.

- Cullen/Frost Bankers, a Texas bank, seems to have dividend growth rates that jumped in the last yr, but the rate probably would not become above 15% in the future.

- First Source Corp., an Indiana regional banking company, as well seems to take dividend growth rates that jumped in the last year and a 25% dividend growth rate in the future seems possible.

- Franklin Resource, a Californian asset managing director with an additional part in India, seems to have dividend growth rates that slowly rise from 15% to 19%, and the rate could slowly rise to 25% in the hereafter.

- Illinois Tool Works, a manufacturer of industrial products and equipment, seems to have dividend growth rates that may abound to thirty% after seeing a rapid ascent from eleven% to 20%.

- Home improvement provider Lowe's seems to have 10-twelvemonth, v-year, 3-yr, and i-twelvemonth dividend growth rates that remained about 20%, and this may last for the foreseeable futurity.

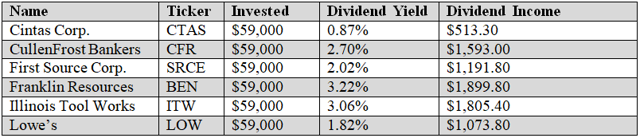

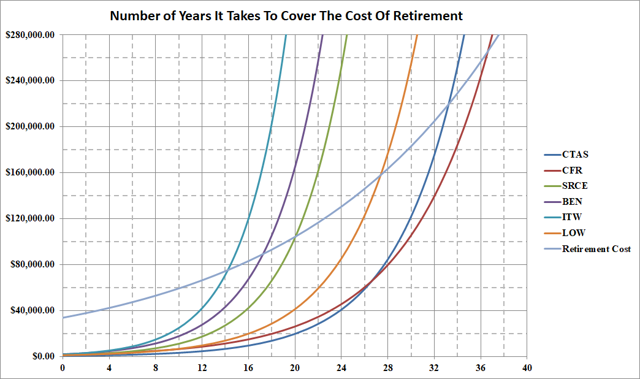

The table beneath is how much dividend income each investment would requite. The graph below the table shows how many years information technology takes to brand enough dividend income to encompass the cost of retirement.

Number of years it takes to brand enough dividend income to encompass the cost of retirement:

- Bold a xx% DGR for Cintas Corp., it would take about 33 years.

- Bold a xv% DGR for Cullen/Frost Bankers, it would have virtually 37 years.

- Assuming a 25% DGR for First Source Corp., information technology would accept about 20 years.

- Assuming a 25% DGR for Franklin Resource, it would take about 17 years.

- Bold a 30% DGR for Illinois Tool Works, it would have virtually 14 years.

- Bold a 20% DGR for Lowe'due south, information technology would have virtually 28 years.

Determination:

If an investor has $59,000 to invest, information technology can take him every bit lilliputian as 14 years with Illinois Tool Works to earn enough dividend income to comprehend the cost of retirement. The next all-time dividend growth stocks would exist Franklin Resource, Outset Source Corp., Lowe's, Cintas Corp., and Cullen/Frost Bankers. Of course, putting all $59,000 in one stock is risky, so perhaps dividing it among 3 companies is safer. And if one is 45 years onetime and has $59,000 saved, at that place are three dividend growth companies (Illinois Tool Works, Franklin Resource, and First Source Corp.) that could make enough dividends to cover the cost of retirement by age 65.

This article was written by

Investor. Mission: Help people make money. Degree: Chemistry from NC State Academy. Freelance writerFor short-term ideas about big movers, follow my StockTalks. But please note I am non the best brusk term stock picker. I am vii-0-1 in the long term, simply 0-3 in the brusk term. Recommended authors:Micheal Filloon (oil shale/short term and long term)Brad Thomas (REIT short and long term)Taylor Dart (mainly gold short and long term also swing/trend trader)Ian Bezek (long term trader and new ideas)Over the last 12 years, I am 7-four-i. I was up 130%, 29%, 15%, 3%, nineteen%, 25%, 56% from 2001-2007 respectively, and down 39%, 39%, 79% from 2008-2010 respectively. In 2011, I was apartment, but some ill-timed trades (should accept held AG) caused a loss of 17% and 14% in 2012 and 2013. Note: gains and losses include transaction costs. 2009 and 2010, I traded oft, calculation upward transaction costs. That is why I favor long term holding over short term trading.I invest in all stocks. I don't agree that U.s. stocks are the safest. Want a condom stock, try TEVA. Information technology did not fall much, or at all, during the credit crisis. And generics are the future.Existence a chemical science graduate, I tend to focus of the drug, medical, biotech, and chemical industries. So far, I wrote about v medical companies (RPC, OREX, KV.A, PLX, & XOMA). OREX and KV.A were right on target, though KV.A has fallen back hard after reaching their highs, which surprised me. PLX was half correct: it did become a negative letter from the FDA, but the options strategy was incorrect. For RPC, and so far, I have been wrong, and exited my position in mid-May. XOMA also has fallen since I wrote near information technology.However, I besides comprehend diverse stocks, from BIDU to NCT. Ignoring other industries is a big fault. I look for stocks I find undervalued on both a value perspective and a growth perspective, but placing more accent on growth. I combine both cardinal and technical analysis. The fundamentals just tell you part of the story.Anybody tin can make money. Don't let Wall Street analysts dispense yous. Their assay is practiced, but don't take everything they say. Proficient luck investing, and I will practise everything I tin to make you money.Oh, and I invest in rather risky stocks with high potentials. If you lot are nearing retirement, I don't recommend you copy my portfolio. I will label my stocks with the adventure/reward factor. I am adding a watch list with some stocks for retirement investors that I like. All watch list stocks are long term holdings.Electric current holdings:O (low take a chance/medium reward)DLR (low hazard/medium reward)RDS.B (low risk/medium reward)OKE (medium risk/medium reward)CGC (medium risk/high advantage)GBTC (medium risk/high advantage)MMNFF (medium adventure/high reward)BTCS (high run a risk/high reward)BTSC (high risk/high reward)MCOA (high chance/loftier reward)MGTI (high risk/very loftier reward)HVBTF (high hazard/very high reward)XXII (high gamble/very high reward)RGSE (very very high risk/high/if any reward)SUNEQ (bankrupt/no reward)Watch list:ROK (medium adventure/medium advantage)AG (medium risk/medium reward)EXK (medium risk/medium reward)GTIM (medium chance/high reward) BOJA (medium run a risk/loftier reward)SWKS (medium run a risk/high reward)JAZZ (medium risk/loftier reward)NFLX (medium risk/high reward)LVS (medium take a chance/high reward)SAM (medium adventure/high advantage)CMG (medium risk/high reward)ZNH (medium risk/high advantage)RDY (medium risk/high reward)NVDA (depression risk/high reward)AVGO (low take chances/medium reward)CF (low risk/high reward)TTM (depression risk/high advantage)NVO (low risk/high advantage)BIDU (depression risk/high advantage)PCLN (depression risk/high advantage)CLF (low risk/medium reward)AAPL (low risk/medium reward)GOOG (low risk/medium advantage)TEVA (depression adventure/medium advantage)GOL (low risk/medium reward)CIM (low adventure/medium reward) - dividend stock

Disclosure: I/nosotros have no positions in any stocks mentioned, but may initiate a long position in LOW, ADP, APD over the next 72 hours. I wrote this article myself, and it expresses my ain opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any visitor whose stock is mentioned in this commodity.

Source: https://seekingalpha.com/article/4211917-beat-recession-dividends-part-3

Posted by: fureyexedger.blogspot.com

0 Response to "How To Make Money In Alpha 3.1"

Post a Comment